The global markets have experienced a sudden and violent shift, leading to significant declines in major indexes like the Dow Jones Industrial Average. Influential factors include Japan’s biggest market crash since Black Monday in 1987 and significant sell-offs by Warren Buffett, indicating heightened economic fear and anxiety.

Throughout 2024, investor sentiment has wavered between frustration over slow economic growth and optimism about the end of inflation. Recently, however, Wall Street’s mood has darkened due to alarming economic data, causing a sharp sell-off in U.S. stocks and a plunge in speculative assets like Bitcoin. The probability of a recession has increased dramatically, prompting a reassessment of market strategies.

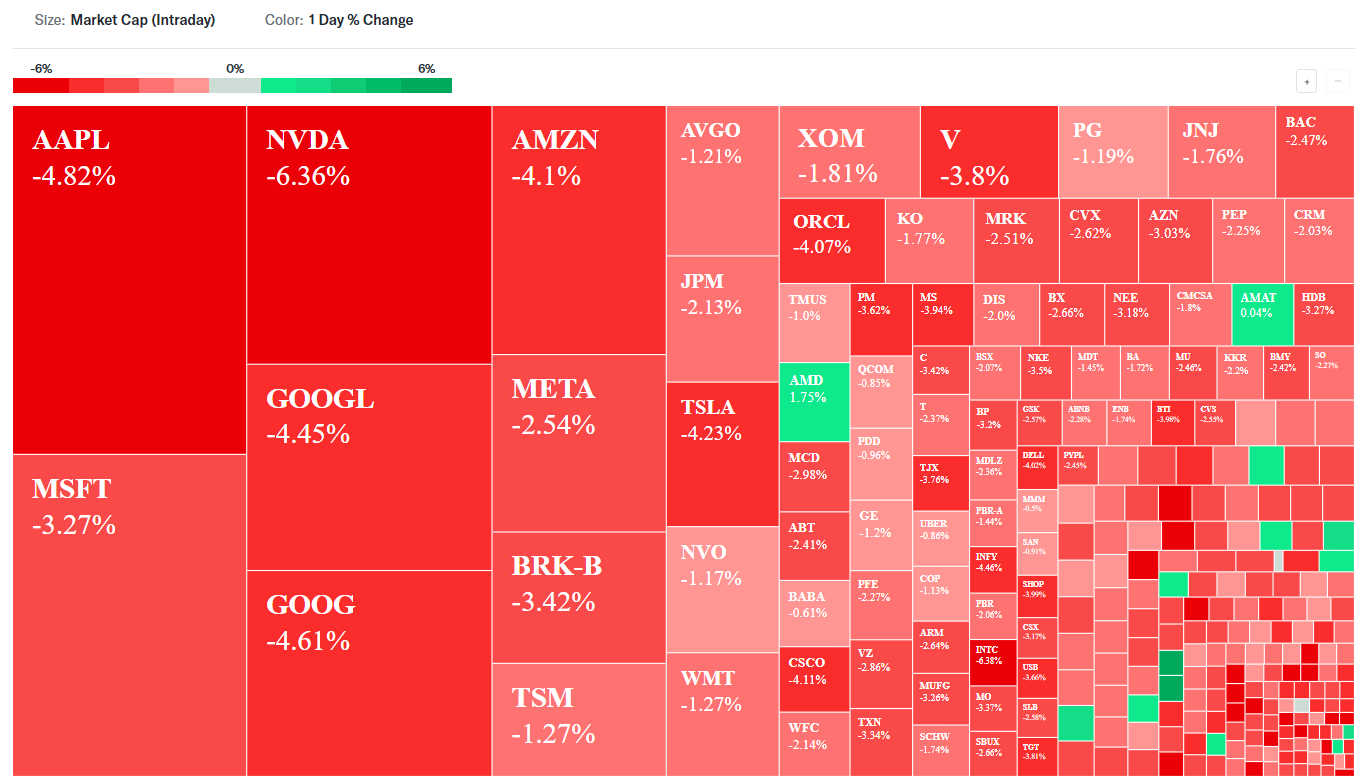

Markets Are Deep in the Red

Major U.S. indexes are in a downturn, with the VIX reaching levels unseen since the early days of the 2020 pandemic. Bitcoin has fallen by 18%, Japan’s Nikkei index dropped 12%, and the Nasdaq has entered a correction. This decline is partly due to a reevaluation of the tech-heavy bull market, with significant losses in companies like Nvidia.

Unemployment Report and Fed Decisions

Recent data revealed a rising U.S. unemployment rate, causing recession fears to escalate. While some economists argue the report reflects an economy in transition rather than one on the brink of collapse, the combination of the bad unemployment report and the Fed’s decision to maintain high-interest rates has spooked markets.

Japan’s Impact

The Bank of Japan’s decision to raise its benchmark rate disrupted the global economy’s cheap money supply, triggering a sell-off in assets purchased with borrowed yen. This move has contributed to the current market turmoil, as traders adjust their strategies.

Looking Ahead

The future remains uncertain, with the possibility of further economic fallout. However, Freeway Real Estates is committed to supporting our clients through these challenging times. We continue to provide real-time market analysis, diversified investment strategies, and robust client support to help navigate the volatility.

Effect on Commercial and Residential Real Estate

The recent market volatility could significantly impact both commercial and residential properties in Canada. For commercial properties, economic uncertainty may lead to reduced investment and slower growth, as businesses become more cautious with expansion and leasing decisions. This could result in higher vacancy rates and pressure on rental prices. On the residential side, potential buyers might delay purchases due to fears of a recession and tighter lending conditions, while existing homeowners could face increased mortgage stress if interest rates remain high. Overall, the real estate market may experience slower activity and more cautious sentiment in the coming months.