Freeway Real Estates Inc. Provides Market Update

The GTA industrial real estate market is undergoing a notable shift. While the sector has experienced unprecedented growth in recent years, emerging trends indicate a potential market correction.

Market Overview

Despite historically low vacancy rates, the GTA industrial market is showing signs of cooling. The vacancy rate, currently at 2.6%, is on the rise, doubling from the previous year. This increase is primarily attributed to a surge in new supply, with over 35% of space delivered since the beginning of 2023 currently available.

Moreover, the availability rate, a more forward-looking indicator, has surpassed the national average for the first time since 2016. This suggests that the market is transitioning from a landlord’s to a tenant’s market.

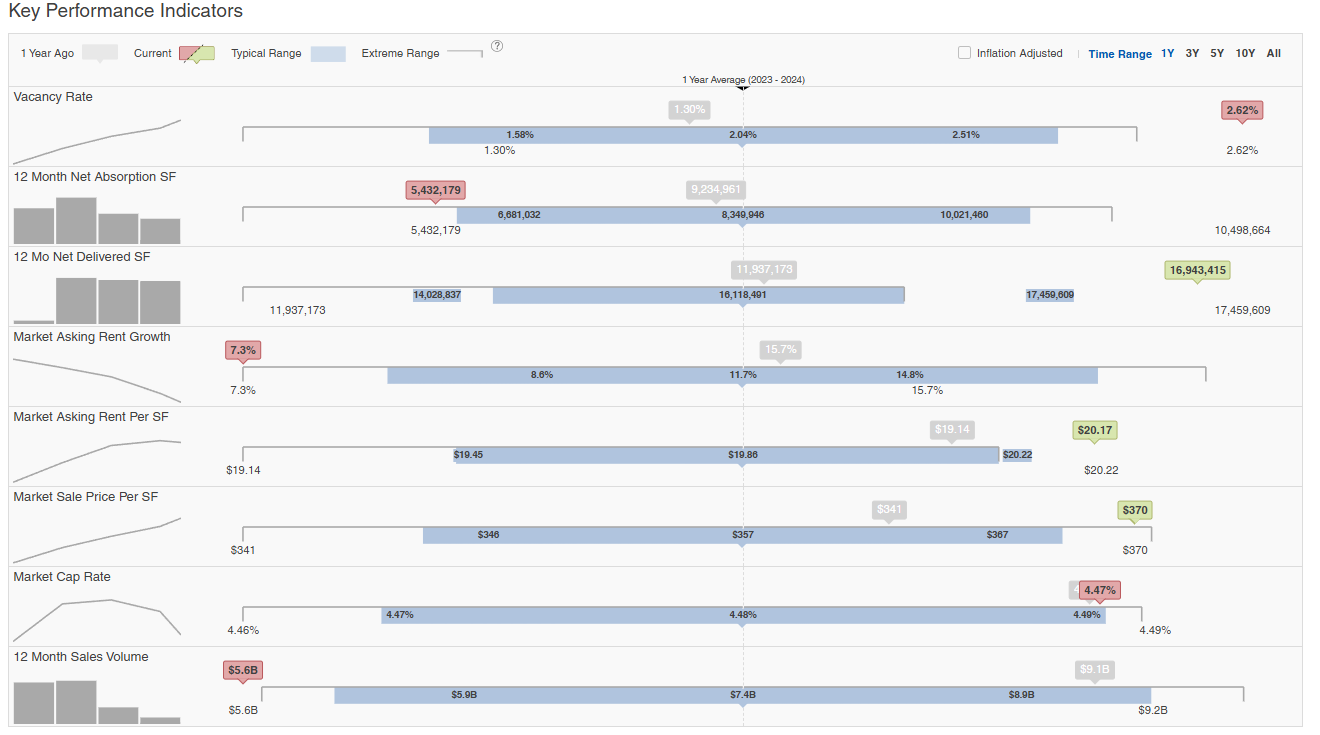

- Vacancy Rate: Currently at 2.04%, it has been steadily declining from a high of 2.62% a year ago. This indicates a tightening market with decreasing available space.

- 12-Month Net Absorption (SF): At 5,432,179 square feet, it’s within the typical range but below the extreme range. This suggests moderate demand for industrial space.

- 12-Month Net Delivered (SF): 16,943,415 square feet of new industrial space has been delivered in the past year, exceeding the typical range. This indicates significant new supply entering the market.

- Market Asking Rent Growth: Increased by 7.3%, surpassing the typical range. This reflects strong rental growth in the industrial market.

- Market Asking Rent Per SF: Currently at $20.17, it has increased from $19.14 a year ago, aligning with the overall rent growth.

- Market Sale Price Per SF: At $370, it’s within the typical range, indicating stable pricing for industrial properties.

- Market Cap Rate: Remains steady at 4.47%, within the typical range, suggesting consistent investor returns.

- 12-Month Sales Volume: $5.66B, below the typical range, indicating lower sales activity compared to previous periods.

Overall Market Assessment:

The industrial market is currently experiencing a mix of positive and negative trends. While the vacancy rate is declining and rental growth is strong, the significant increase in new supply and lower sales volume could impact future market conditions.

Potential Implications:

- Increased Competition: The influx of new industrial space may intensify competition among landlords, potentially leading to downward pressure on rental rates.

- Tenant Leverage: With more options available, tenants may have increased bargaining power in lease negotiations.

- Market Segmentation: The impact of new supply and demand dynamics may vary across different industrial submarkets.

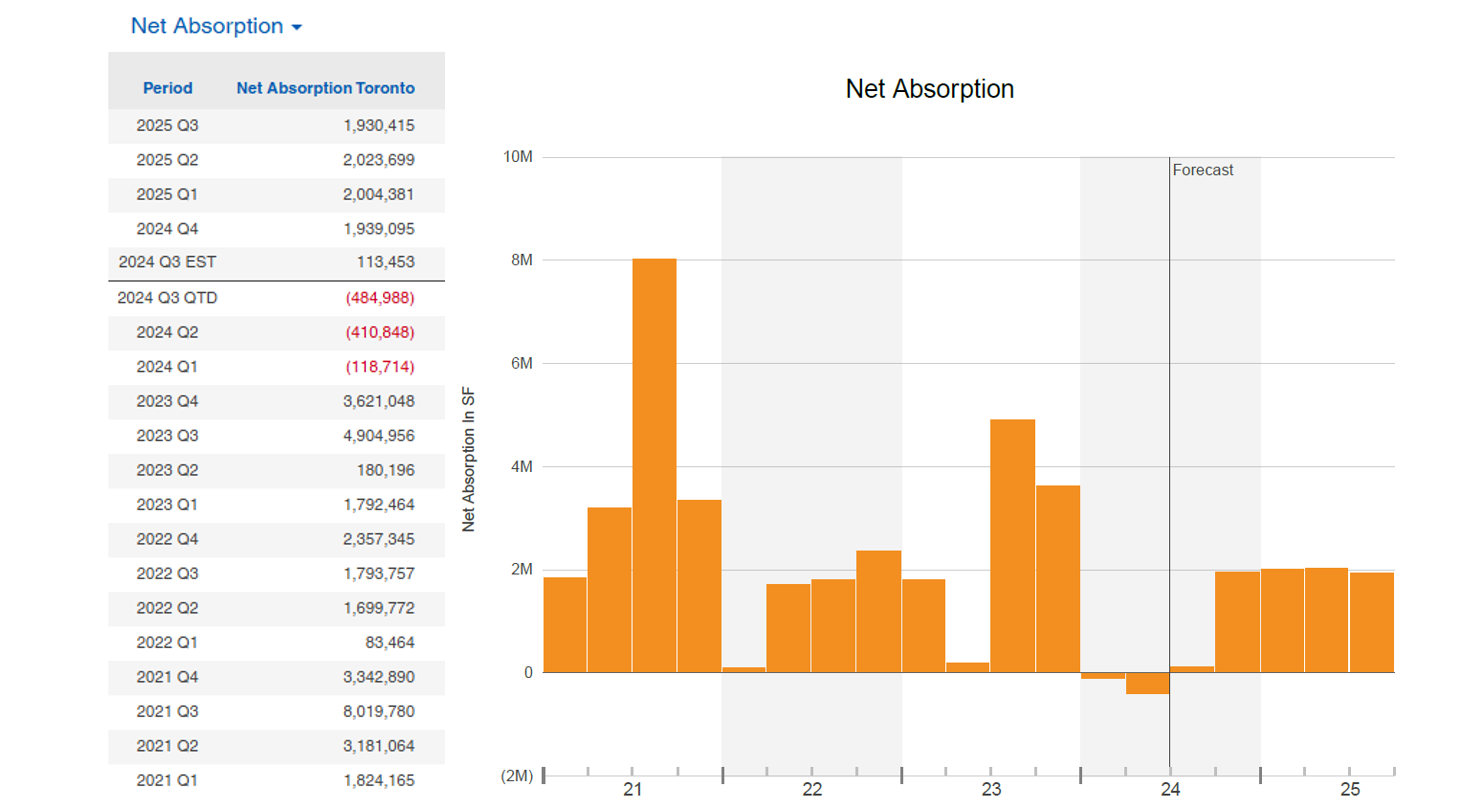

Net Absorption Rate

Net absorption has been impacted by the influx of new supply. While large units (100,000 sq ft and above) continue to be absorbed, the market for smaller units has contracted. This trend is likely to persist as developers focus on larger, more efficient buildings to meet evolving tenant demands.

What is Net Absorption?

Net absorption is a measure of the change in occupied commercial real estate space over a specific period. A positive number indicates that more space has been leased than vacated, while a negative number signifies the opposite.

Key Observations:

- Fluctuations: Net absorption varies significantly from quarter to quarter.

- High Absorption Periods: There were periods of high net absorption, particularly in Q3 of 2021 and 2023.

- Negative Absorption: Some quarters, especially in 2024, show negative net absorption, indicating more space became vacant than occupied.

- Q3 2024 Estimate: The estimated net absorption for Q3 2024 is positive but relatively low compared to previous quarters.

Potential Implications:

The data suggests that the Toronto commercial real estate market has experienced fluctuations in demand. Periods of high net absorption indicate strong market conditions with high occupancy rates, while negative figures suggest challenges in leasing vacant space. The relatively low estimated net absorption for Q3 2024 might indicate a slowdown in the market or potential oversupply.

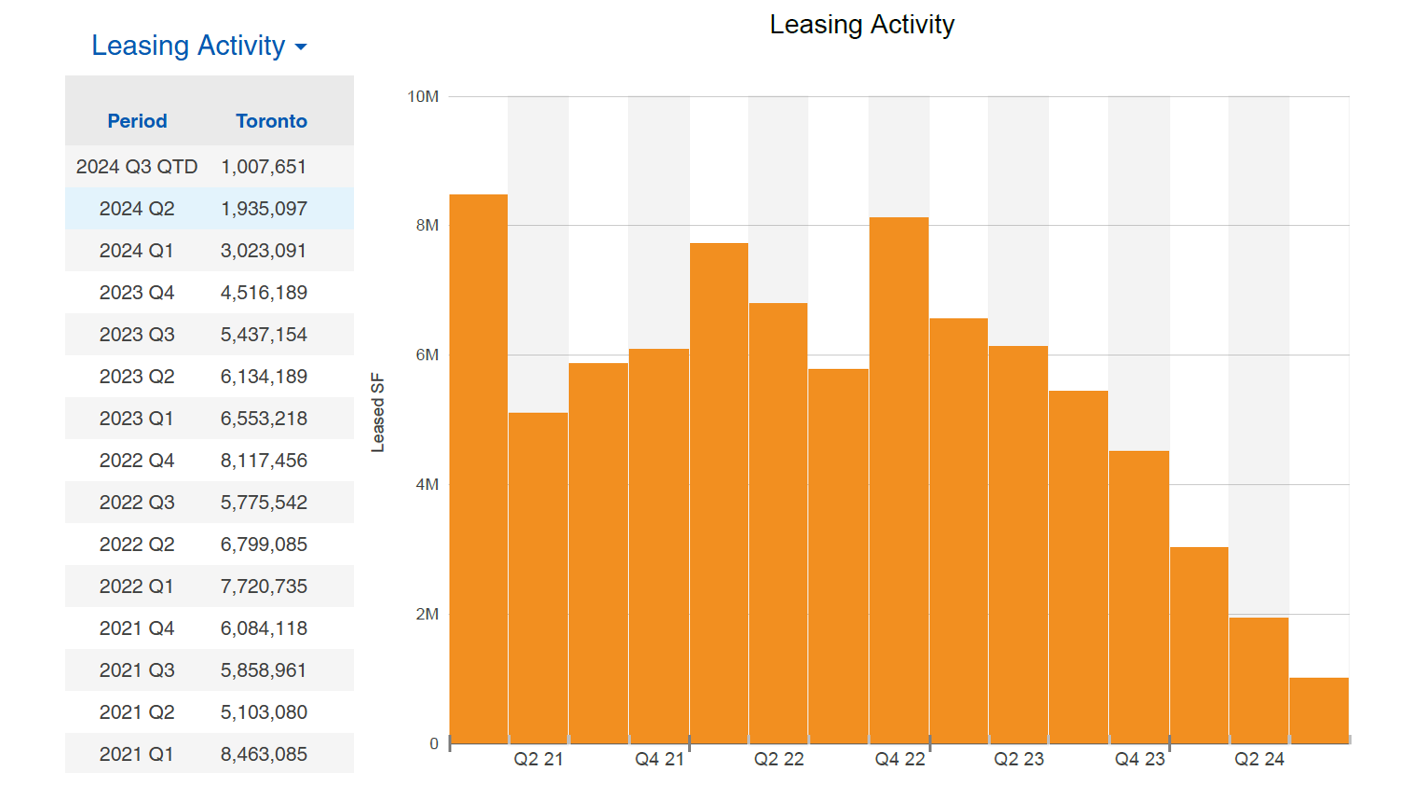

Leasing Activities

Leasing activity in the GTA industrial market has softened in 2024 compared to 2023. While there’s a seasonal pattern with higher activity in Q1 and Q4, overall leasing volume has declined throughout the year. Q3 2024 is on track to be the weakest quarter so far, with only 1,007,651 square feet leased compared to a much higher volume in the previous year. This slowdown could be attributed to economic factors, increased vacancy rates, or other industry-specific trends. Looking ahead to the rest of Q3, leasing activity is likely to remain subdued.

Potential Implications:

The sustained decline in leasing activity carries several potential implications for the industrial real estate market:

- Increased Vacancy Rates: As leasing activity slows, vacant spaces are likely to accumulate, leading to higher vacancy rates. This could put downward pressure on rental rates.

- Landlord Challenges: Property owners may face difficulties in maintaining occupancy levels and rental income, potentially impacting cash flow and property valuations.

- Tenant Leverage: With increased vacancy, tenants may have greater negotiating power in lease terms, seeking lower rental rates, longer lease terms, or additional concessions.

Vacancy Rates and Market Asking Rent

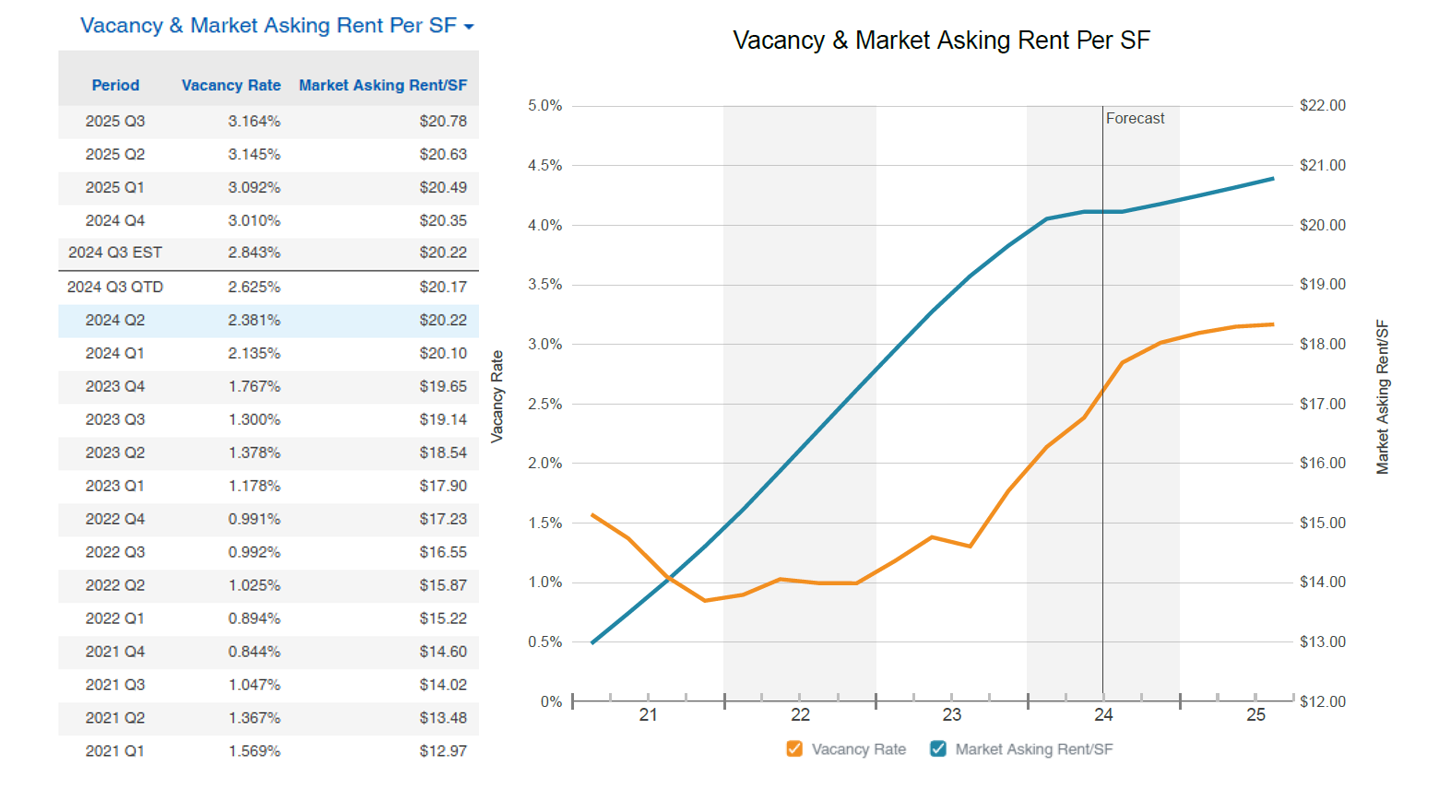

The Toronto commercial real estate market has experienced a dynamic interplay between vacancy rates and market asking rents. Historically, a declining vacancy rate has correlated with increasing rental prices, indicative of a tightening market. This trend is rooted in basic supply and demand economics: as available space dwindles, landlords can command higher rental rates.

However, the market has shown signs of shifting. While vacancy rates have been on a downward trajectory, recent data suggests a potential plateau or even a slight uptick. This could be attributed to several factors including increased new supply, economic uncertainties, or a change in tenant demand.

Concurrently, market asking rent growth has decelerated. While still positive, the rate of increase has moderated. This suggests that landlords may be adopting a more cautious approach to pricing, potentially in response to the softening demand indicators.

It’s crucial to note that these trends are likely to vary across different property types and submarkets within Toronto. Factors such as location, building quality, and amenities can significantly influence vacancy rates and rental prices.

Trends and Observations:

- Inverse Relationship: Generally, there seems to be an inverse relationship between vacancy rate and market asking rent. As the vacancy rate decreases (more space occupied), the market asking rent tends to increase.

- Market Tightening: From 2021 to mid-2023, the vacancy rate was consistently low, indicating a tight market with high demand for commercial space. This corresponded with a steady increase in market asking rent.

- Market Loosening: Since mid-2023, the vacancy rate has been gradually increasing, suggesting a loosening of the market with more available space. Concurrently, the growth in market asking rent has slowed down.

- 2024 and 2025 Forecast: The data includes estimated figures for 2024 Q3 and projections for 2025 Q1, Q2, and Q3. These projections suggest a continued increase in the vacancy rate and a slower pace of rent growth.

Potential Implications:

- Landlord Perspective: Landlords may face challenges in maintaining high occupancy rates and rental prices as the market loosens.

- Tenant Perspective: Tenants may have more negotiating power as the vacancy rate increases, potentially leading to better lease terms.

- Market Outlook: The overall trend indicates a potential shift from a landlord’s market to a more balanced market.

Q3 Outlook

Freeway Real Estates Inc. anticipates a period of adjustment in the GTA industrial market during Q3. While the fundamentals remain relatively strong, the increasing availability of space will likely lead to downward pressure on rental rates and increased tenant leverage.

Key factors to watch include:

- Vacancy and Availability Rates: The trajectory of these metrics will be crucial in determining market direction.

- New Supply Deliveries: The pace of new construction completions will continue to impact market conditions.

- Tenant Demand: Shifts in tenant requirements and preferences will influence leasing activity.

- Economic Indicators: Overall economic performance will affect industrial demand.

While the market is undergoing a correction, Freeway Real Estates Inc. believes that the long-term prospects for the GTA industrial sector remain positive. Our team is committed to providing clients with expert guidance and support to navigate this evolving landscape.

Note: This analysis is based on the provided data and general market trends. It’s essential to consider additional factors and conduct further research for a comprehensive understanding of the industrial market. Freeway Real Estates Inc., Brokerage, uses data provided by CoStar Group, Inc. (“CoStar”) for the purpose of generating market analysis and insights. While Freeway Real Estates Inc., Brokerage believes the data to be accurate and reliable, it does not guarantee the accuracy, completeness, or timeliness of the information provided. The data is subject to change without notice. Any reliance on the data provided is solely at the user’s own risk. Freeway Real Estates Inc., Brokerage assumes no liability for any errors, omissions, or discrepancies in the data.